Legal Disclaimer: This is not financial advice, it’s possible the facts/figures here are wrong because of my own malfeasance/stupidity. If you make financial decisions based on this post you deserve to lose all your money, and probably will. I am not liable to you for any actions you take or don’t take based upon the information in this article.

If a company has $625 million to spend, and the best thing they can think to do with it is purchase the naming rights to an NFL stadium, MLB field, or NBA arena, it’s fair to ask if they’ve run out of good ideas. Advertising is fine, and probably provides a good ROI when done well. Still, I’m not sure anyone walks into - let’s say - Lucas Oil Stadium and gains a newfound preference for a particular motor oil. This analysis from Axiom Alpha looks at the financial performance of 10 companies with naming rights to NFL stadiums. From the writeup: “Of the 10 companies we just analyzed, 9 underperformed a basic portfolio consisting of a 50/50 split allocation between their industry peers (represented as a sector ETF where one existed and by an equal weight index of direct competitors where one did not) and the S&P 500”. 90% is quite a signal.

What got me thinking about this? Recently we’ve witnessed the collapse of several financial institutions in the crypto space (FTX, Celsius, BlockFi, Three Arrows Capital, Voyager). You might not be surprised to learn that some of these companies saw fit to spend their budgets on naming rights to major league venues. The Miami Heat play at FTX Arena, the LA Kings/Clippers/Lakers play at Crypto.dot Arena (at least as of 11/15/22, though probably not for long). It appears that perhaps there is some correlation between bad business practices and buying naming rights to a stadium. The analysis I linked above suggests 90% underperform the market when naively we might expect 50%. Still, this was based on 10 companies. Perhaps the sample size was too small?

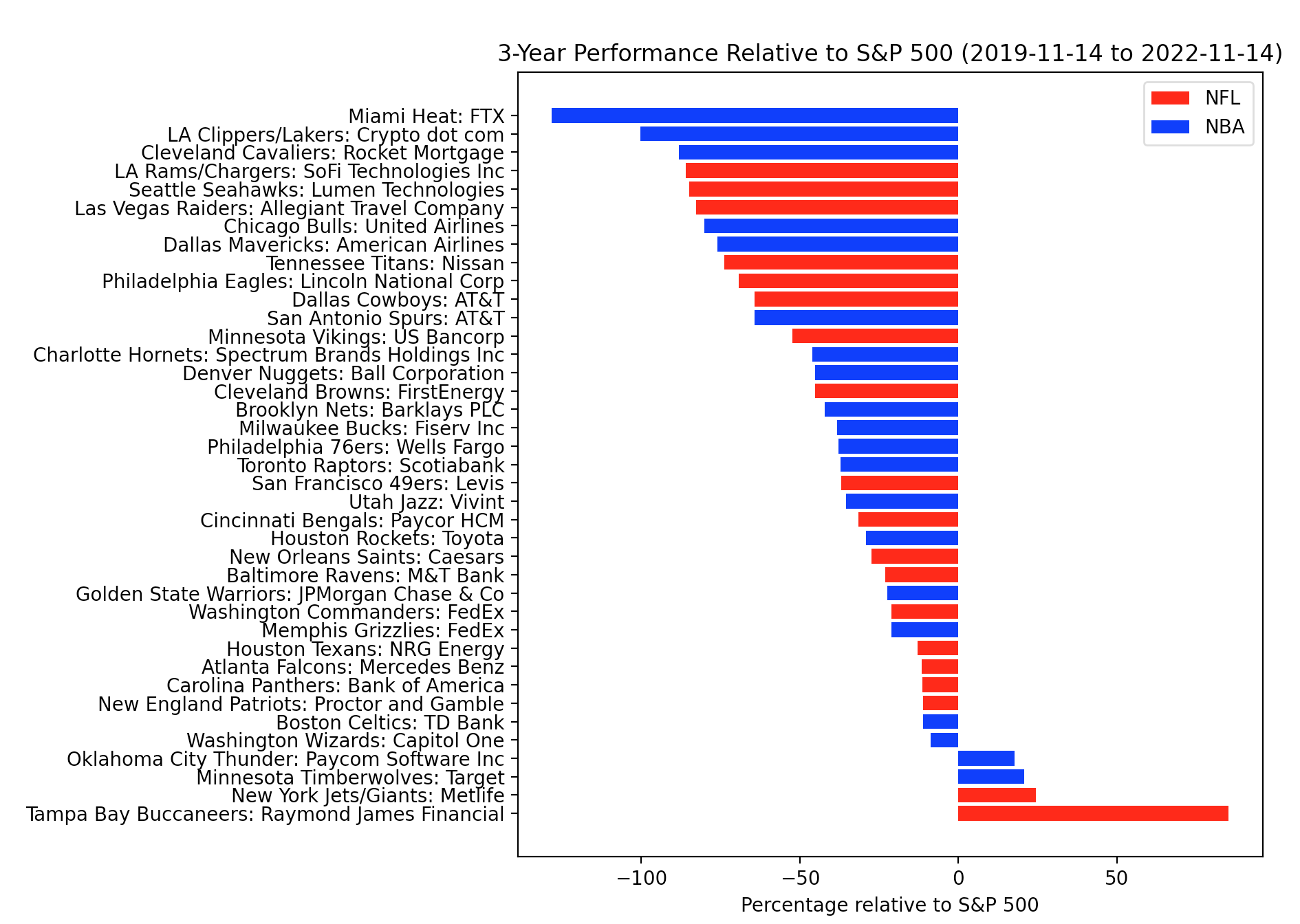

I wrote a little script to look into the performance of publicly held companies which have purchased naming rights to NFL and NBA venues. I compared their performance against the S&P 500 over the last three years. I also added one private company (FTX) and marked their loss as 100%, as they just filed for Chapter 11 bankruptcy protection. Some of the companies haven’t had naming rights for the entirety of those three years, but I think this is still fair since the question I’m trying to answer is not “is buying naming rights a bad investment?” but rather “do badly run companies buy naming rights?”.

Results: 35 of the 39 companies I analyzed (89.7%) performed below the S&P 500 (see below). This lines up well with the 90% value from Axiom Alpha. The average relative return was -38.7%. I suspect this is more correlative than causative. For example, it sure doesn’t seem like what sunk FTX was buying the naming rights to an arena in Miami…